Walton Global Launches $2.77M North Carolina Growth 2 DST Offering

Walton Global, a real estate investment and land asset management company and sponsor of private placement investments, launched North Carolina Growth 2 DST, a Delaware statutory trust focused on land-based investments in Greenville, N.C. Known as Allen Tract, the Pitt County offering includes 215 acres intended for residential development.

The offering seeks to raise approximately $2.77 million from accredited investors.

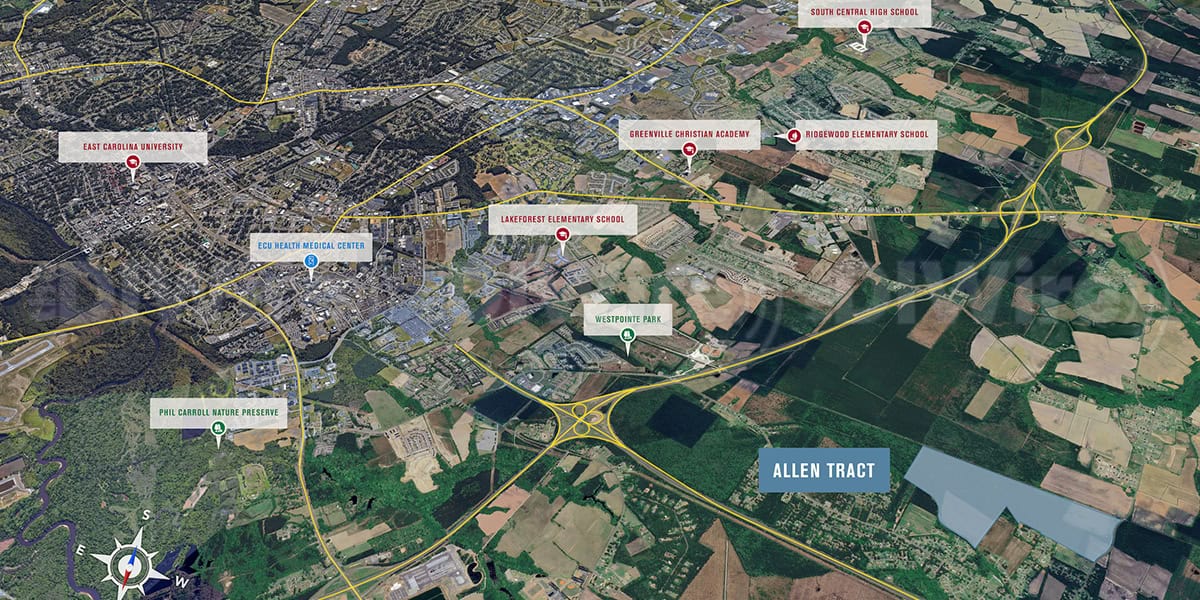

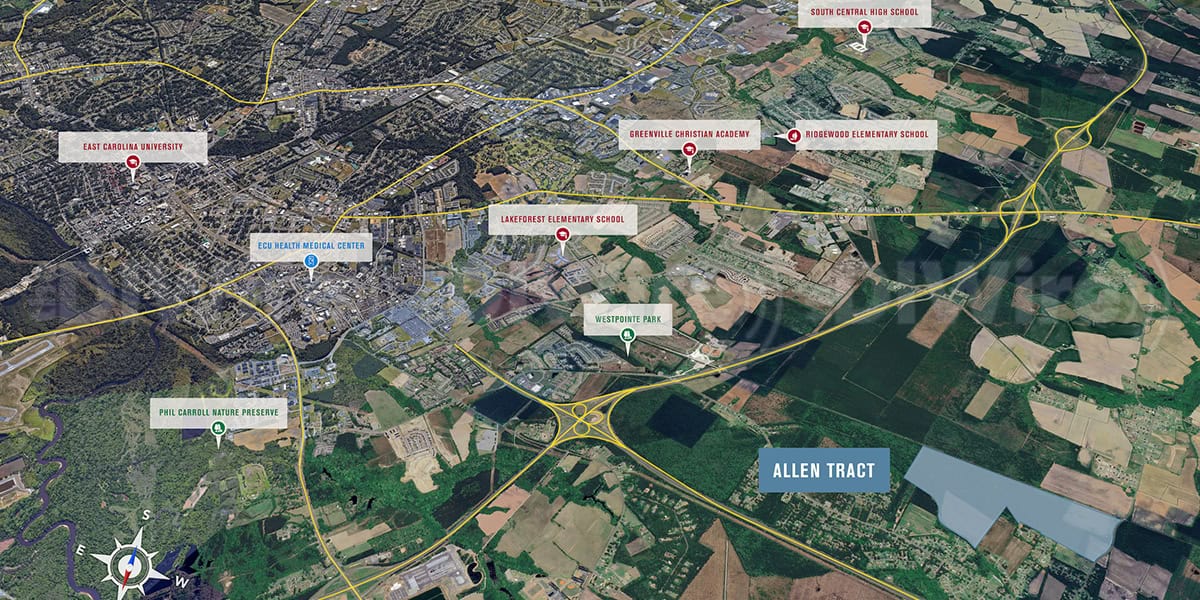

Located just six miles southwest of downtown Greenville, the Allen Tract acquisition reflects Walton’s confidence in Greenville as an emerging hub for residential appeal and investment potential.

Allen Tract is positioned near major landmarks and infrastructures, being a few miles from ECU Medical Center, downtown, Pitt-Greenville Airport and East Carolina University, which enrolls roughly 29,000 students. According to the company, its proximity to significant employment centers, which is approximately a 15-minute drive, adds to the location’s attractiveness for potential homeowners.

Utilities are set to serve the future community, with sewer services including a public lift station readily available onsite, and water supply secured from the Bell Arthur Water Corporation.

“Greenville offers an ideal blend of affordability, convenience and lifestyle – factors that are increasingly important to today’s homebuyers,” said Mike Doherty, executive vice president of land acquisitions at Walton Global. “With the anticipated price range of homes set between $250,000 to $360,000 and various homesite options available, Allen Tract is poised to meet the growing demand for quality residential space in the region.”

Walton intends for the residential community to help meet demand and assist in supplying affordable homes in the U.S. housing market.

As previously stated by Walton Global an article about Delaware Growth 1 DST, the company’s approach to DST offerings since launching in March 2023 emphasizes all-equity potential growth opportunities, aiming for potentially higher investor returns compared to traditional DSTs. This strategy includes avoiding artificially extended hold periods due to the repayment restrictions common in conventional financing.

Walton is a privately-owned, land asset management and global real estate investment company with more than 88,000 acres of land under ownership, management and administration in the United States and Canada, totaling $4.5 billion. With more than 45 years of experience, Walton has a proven track record of land investment projects within the path of growth in the fastest-growing metropolitan areas. A total of $2.5 billion has been distributed to investors located in 87 countries.