Stanger: Retail Alts on Pace to Raise $175 Billion in 2025

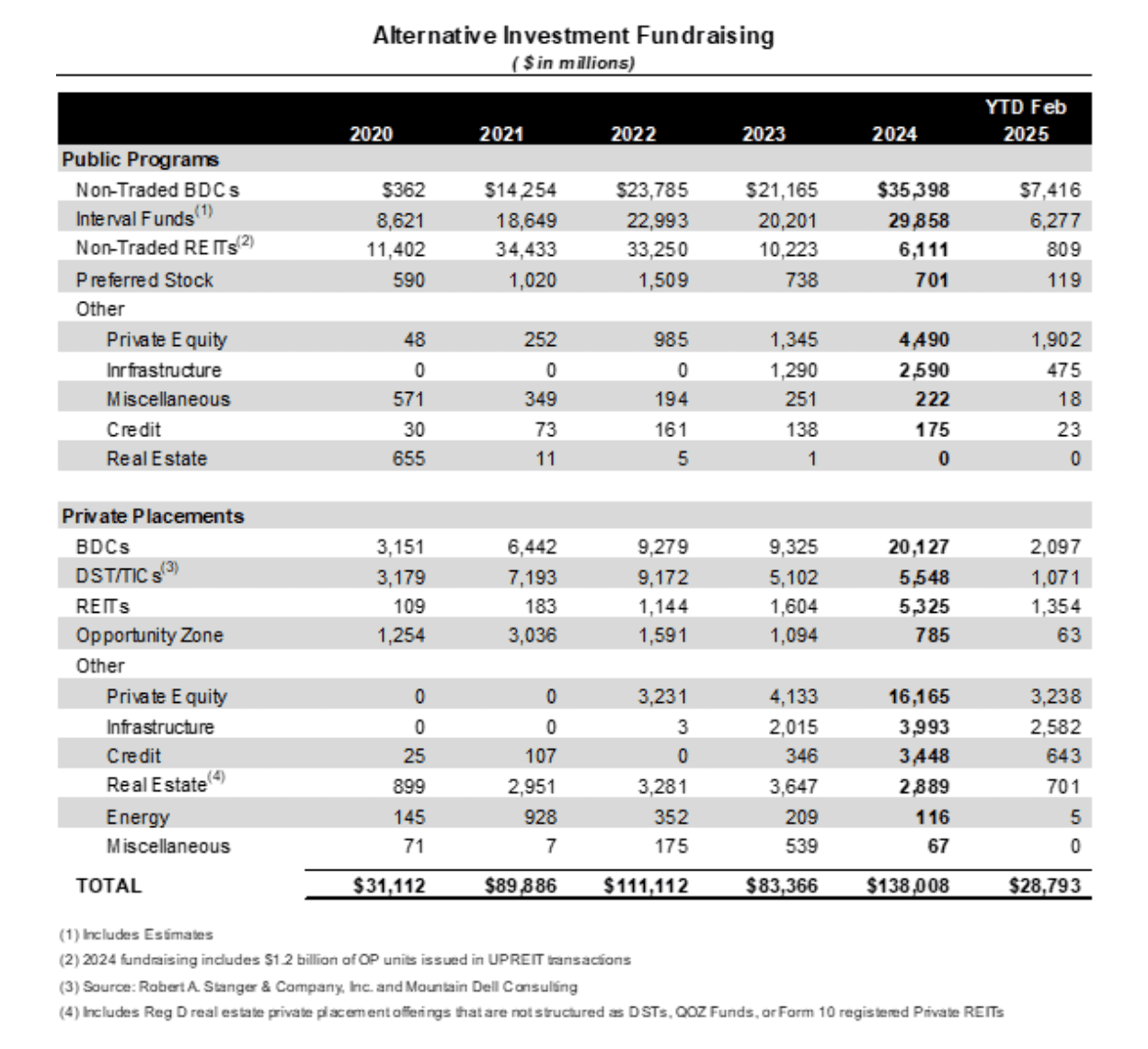

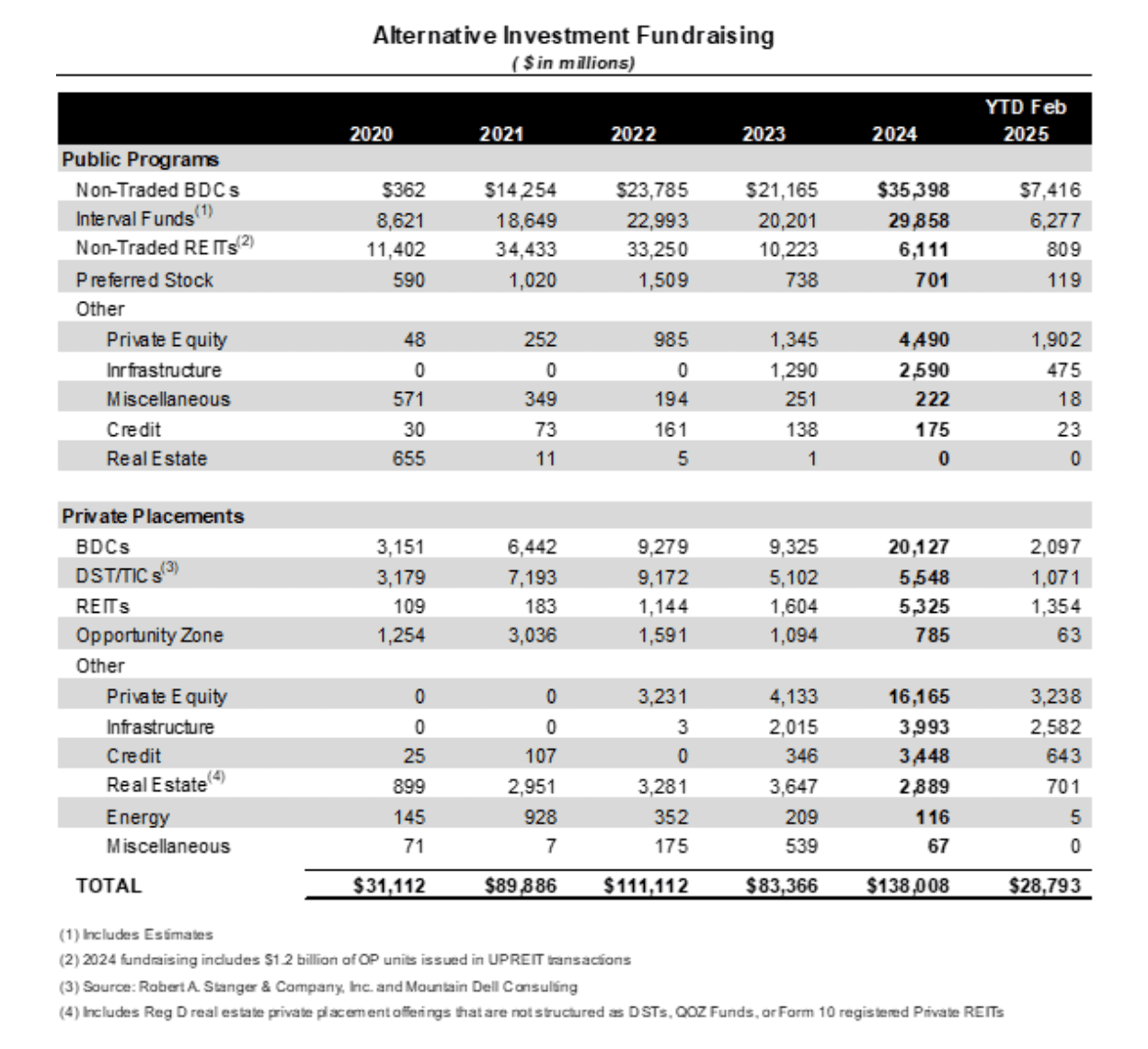

Alternative Investment fundraising amid illiquid and semi-liquid offerings totaled approximately $28.8 billion through February 2025, per the latest data provided by investment banking firm Robert A. Stanger & Company Inc. Non-traded business development companies pace the field with an estimated $7.4 billion, while other offerings including infrastructure and private equity funds raised $7.2 billion, and interval funds brought in $6.3 billion.

Stanger projects that alts fundraising for the year may reach $175 billion. This exceeded the firm’s prior 2025 projection of $160 billion.

Relaying the fundraising data of all alts investments offered via the retail pipeline, Stanger found that non-traded BDC fundraising is up nearly 40.3% compared to this time last year while non-traded real estate investment trust fundraising is down 10.1%, respectively.

The firm said that the industry continues to transform as investors shift their portfolio allocations to private placement offerings, infrastructure, private equity, and higher yielding credit focused investments.

“These changes are the natural outgrowth of semi-liquid alternative investments where investors and financial advisers can re-allocate investments as market conditions change,” said Kevin T. Gannon, chairman of chairman of Robert A. Stanger & Co.

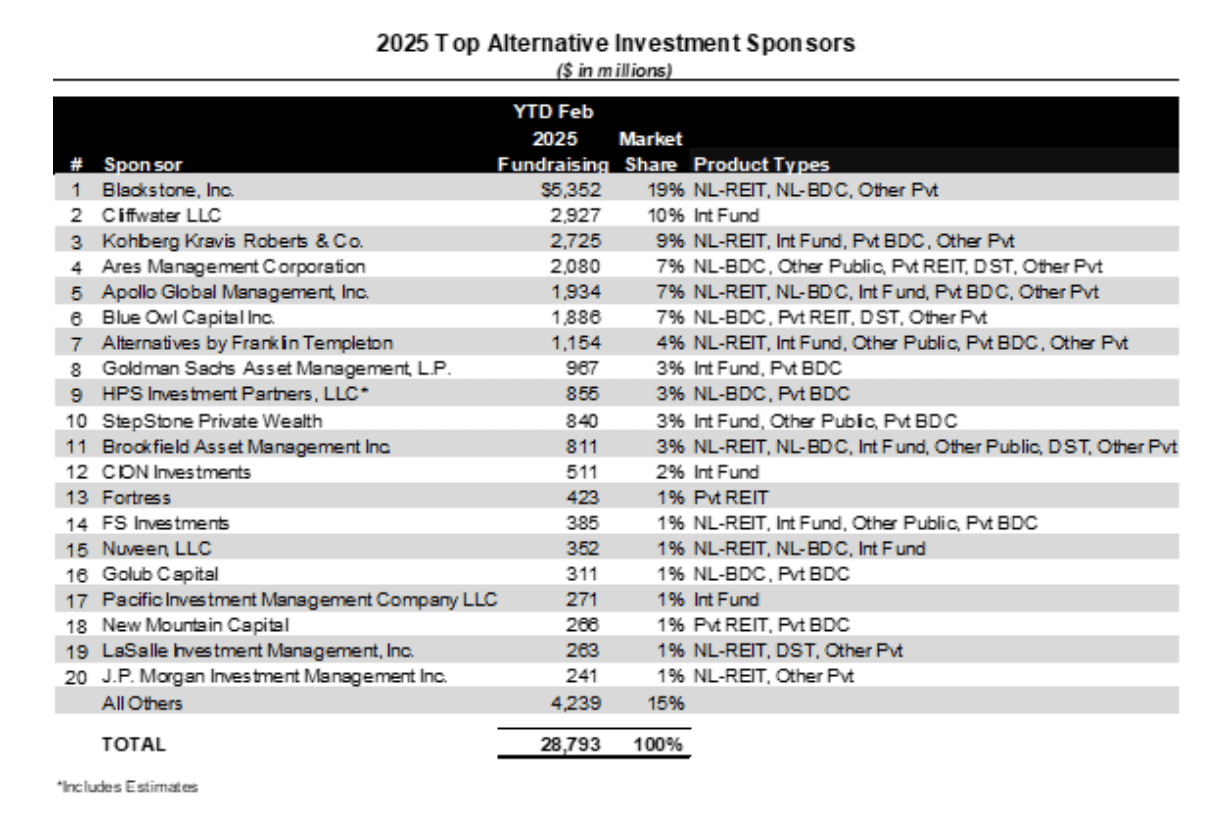

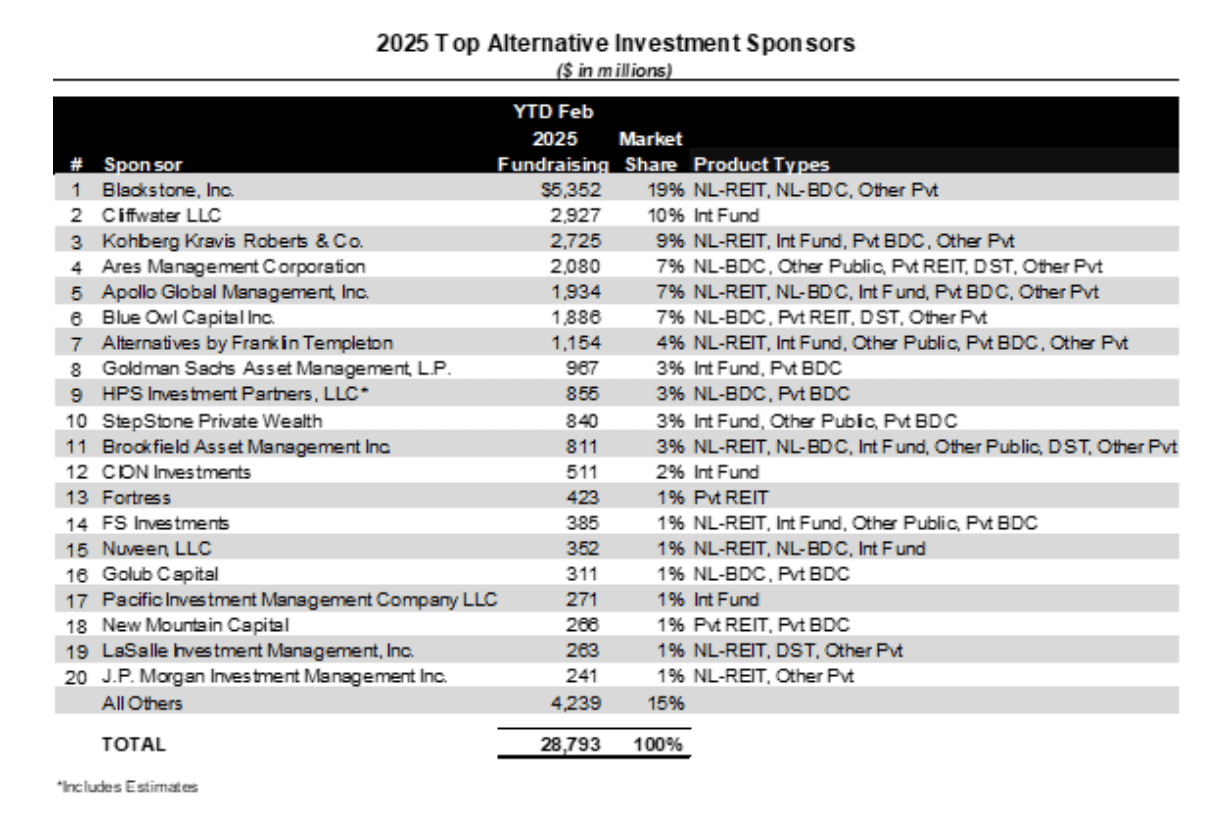

“The top fundraisers in the alternative investment space year-to-date are Blackstone Inc. ($5.4 billion), Cliffwater ($2.9 billion), Kohlberg Kravis Roberts & Co. ($2.7 billion), Ares Management Corporation ($2.1 billion) and Apollo Global Management, Inc. ($1.9 billion),” said Randy Sweetman, executive managing director of Robert A. Stanger & Co.

Stanger’s survey of top sponsors tracks fundraising of all alternative investments offered via the retail pipeline, including publicly registered non-traded REITs, non-traded BDCs, interval funds, non-traded preferred stock of traded REITs, DSTs, opportunity zone, and other private placement offerings.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.