Stanger Projects Fundraising for Interval Funds to Eclipse $37 Billion in 2025

The aggregate net asset value of interval funds reached $107.7 billion in the first quarter of 2025, a 10.5% increase from Q4 2024 and a 37.8% year-over-year surge, marking a significant milestone for the space. This was according to the latest data from investment banking firm Robert A. Stanger & Company Inc.

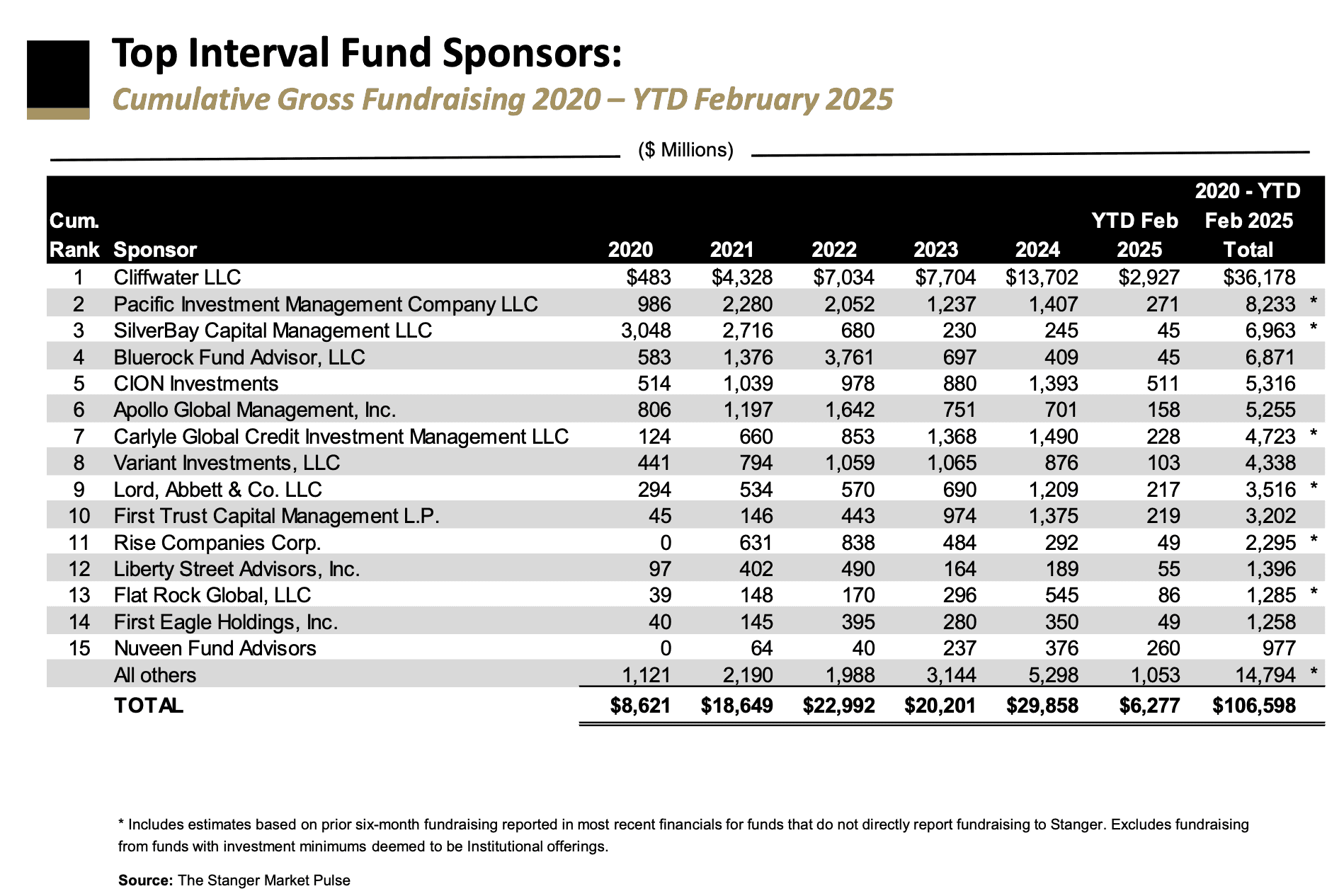

“Interval funds have kicked off 2025 with strong momentum, raising $6.3 billion through February and attracting nearly $32 billion of investor capital over the trailing 12 months – a 46.3% increase from the same period last year,” said Kevin T. Gannon, chairman and chief executive officer of Robert A. Stanger.

The interval fund landscape also saw a notable expansion, with nine new funds becoming effective in Q1 2025, such as Blackstone Private Multi-Asset Credit & Income Fund and Nuveen Enhanced CLO Income Fund, and 13 additional funds filing new registration statements, bringing the total number of pending registrations to 45. The total number of effective interval funds now stands at 129, up from 98 in Q1 2024.

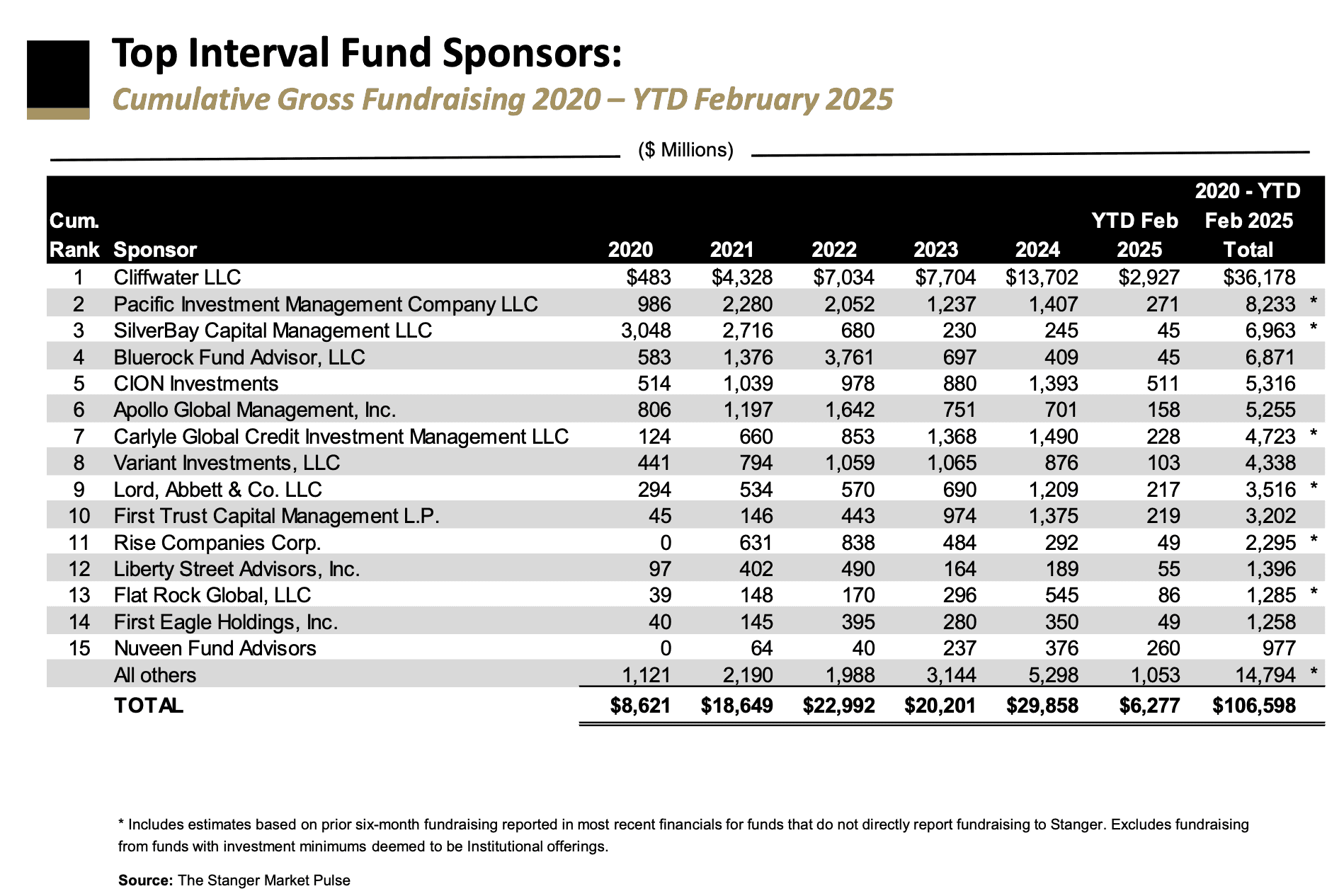

Cliffwater-sponsored interval funds continue to dominate the market, according to Stanger, capturing nearly a 40% market share between its two funds.

“After raising just shy of $30 billion in 2024, Stanger now projects interval funds gross fundraising to eclipse $37 billion in 2025. We’ve also seen redemptions as a percentage of gross sales continue to decline, reaching 29.2% year-to-date through February 2025 compared to 34.6% for 2024,” added Gannon.

Stanger also highlighted standout performers in Q1 2025. Bow River Capital Evergreen Fund led the sector with total returns of 4.7% over three months. Ark Venture Fund topped the six-month total return rankings with 9.2% after leading the three-month returns in the prior quarter. Meanwhile, Cascade Private Capital Fund outperformed the prior quarter’s leader, Stone Trust II, achieving a 12-month total return of 31%.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.