SKRADD Non-Traded Equity REIT Indices Highlight ‘Wide Dispersion of Returns’

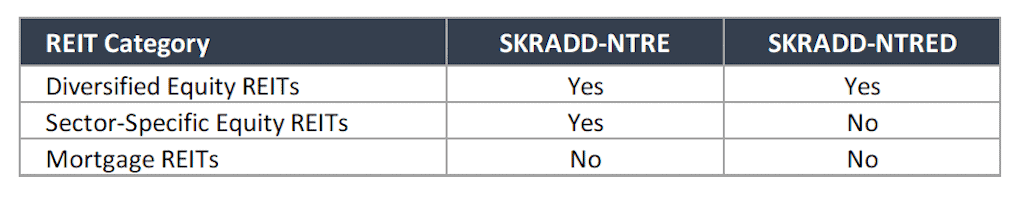

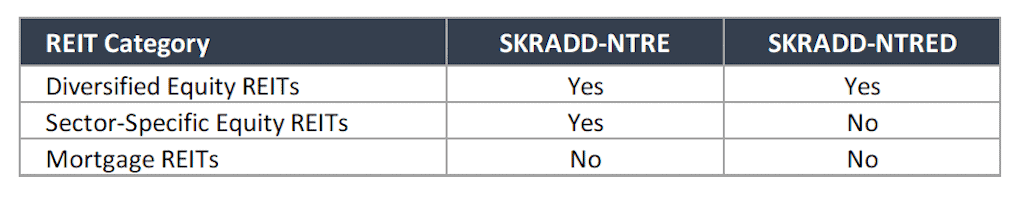

SK Research and Due Diligence, or SKRADD, announced the release of its Q4 2023 Non-Traded Equity REIT indices, which track the performance of the 10 largest non-traded, perpetual-life equity real estate investment trusts that primarily focus on making equity investments in real estate. SKRADD publishes two such indices: the SKRADD Non-Traded Equity REIT Index (SKRADD-NTRE), which includes diversified and sector specific non-traded perpetual life REITs; and the SKRADD Non-Traded Equity Diversified REIT Index (SKRADD-NTRED), which does not include sector-specific REITs.

An affiliate of Snyder Kearney LLC, SKRADD manages Altidar, an online alternative investment research platform that empowers advisers by providing them with independent research covering a range of alternative investment offerings. Launched in winter 2023, Altidar is designed to help advisers explore alternative investment opportunities that are structured for the private wealth channel.

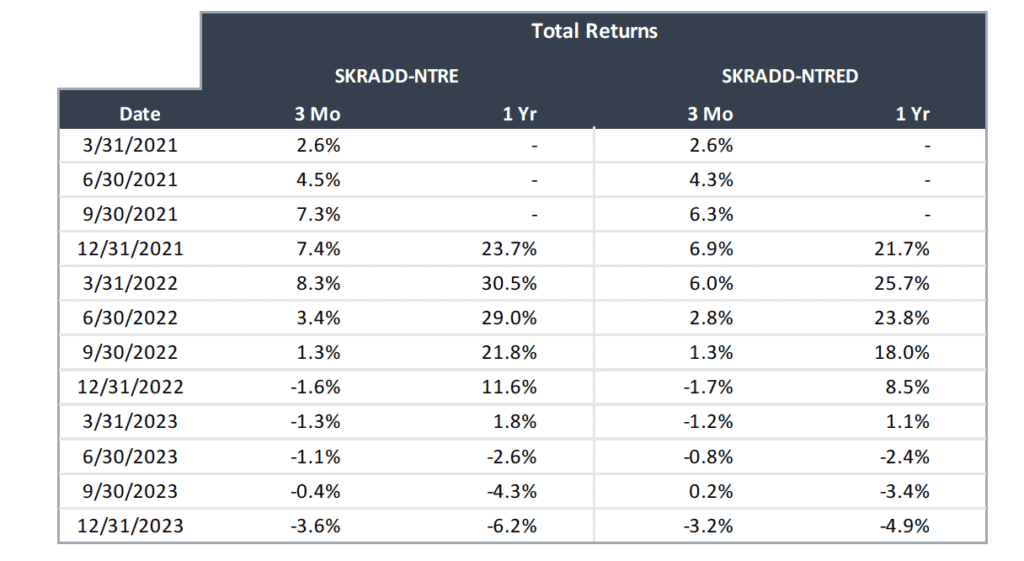

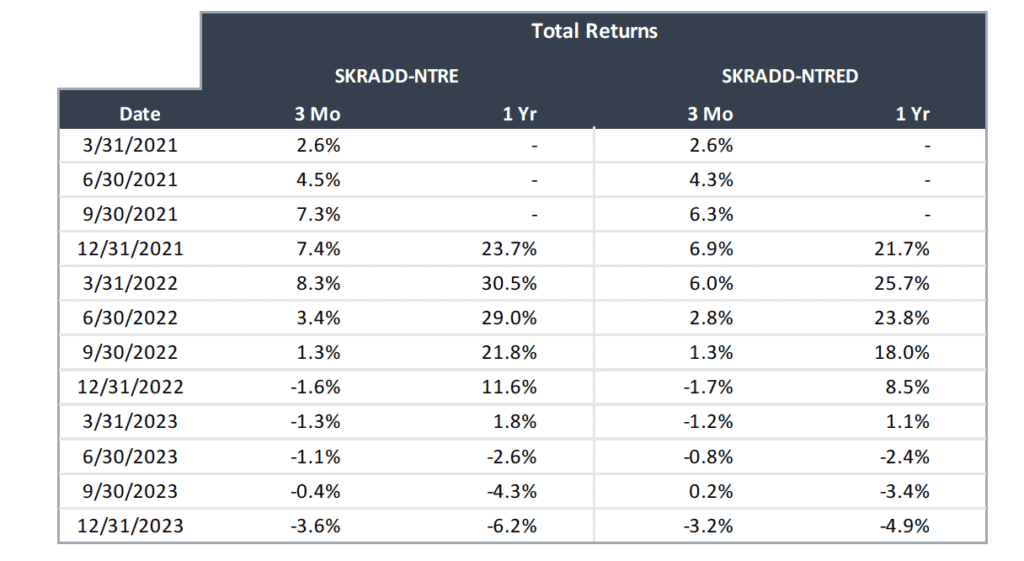

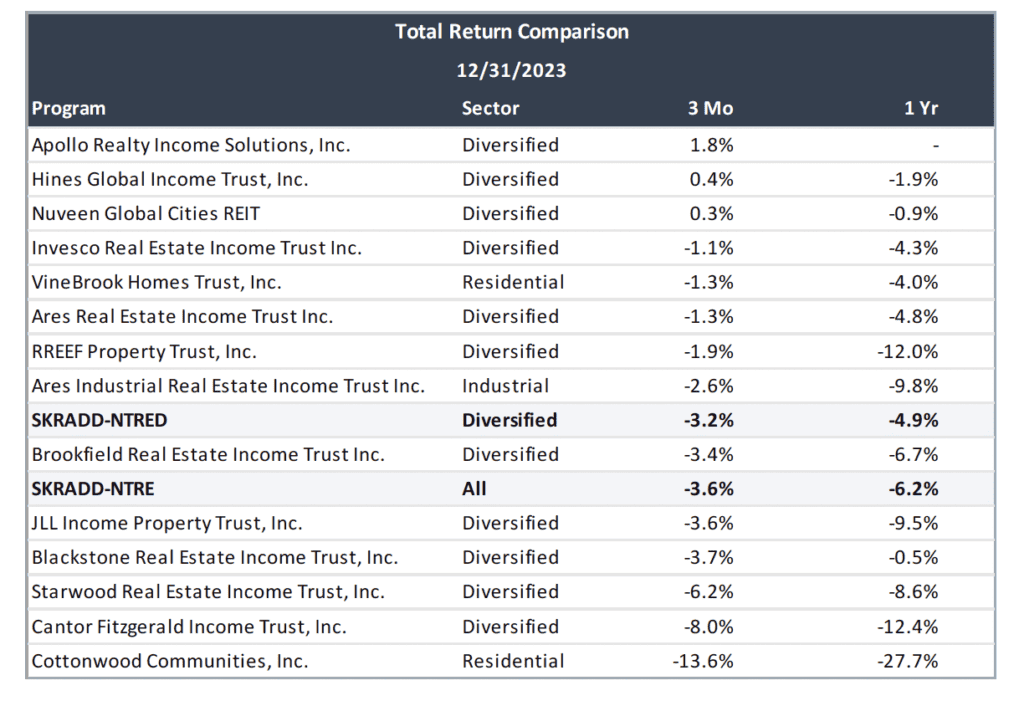

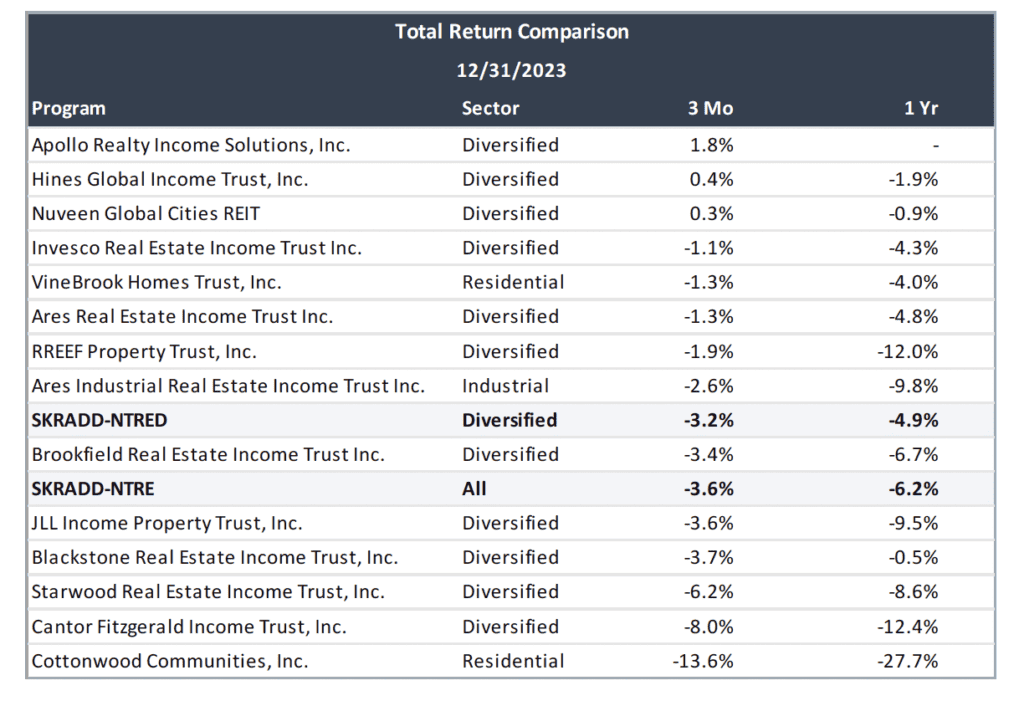

From the SKRADD Non-Traded Equity REIT Indices Q4 2023 report, 2023 was a down year for non-traded equity REITs, as heightened interest rates increased borrowing costs and adversely affected real-estate valuations. For the three- and 12-months ended Dec. 31, 2023, the SKRADD-NTRE index posted returns of -3.6% and -6.2%, respectively, and the SKRADD-NTRED index posted returns of -3.2% and -4.9%, respectively. The SKRADD-NTRE index performance was affected by the performance of two sector-specific REITs, one focusing on multifamily properties, i.e., Cottonwood Communities Inc., and one focusing on industrial properties, i.e., Areas Industrial Real Estate Income Trust, that are not included in the SKRADD-NTRED index.

The results above somewhat mirror the Stanger NAV REIT Total Return Index and the Stanger Lifecycle REIT Index data of Q4 2023. The indexes were down 3.7% and 5.3%, respectively, quarter-over-quarter. The indices currently include 19 NAV REITs (83 separate share classes) and 19 Lifecycle REITs (31 separate share classes).

SKRADD also provided a comparison of its two index returns with the returns of a number of leading non-traded equity REITs covered on SKRADD’s Altidar platform, not all of which are constituents of the indices. All of the covered REITs experienced negative returns for the 12-month period, and all but three posted negative returns for the three-month period. The leader for each of the three- and 12-month periods in terms of total return were Apollo Realty Income Solutions Inc. (1.8%) and Blackstone Real Estate Income Trust Inc. (-0.5%), respectively. Cottonwood Communities Inc., a REIT that invests in multifamily properties, experienced the lowest returns for the three-month period (-13.6%) and 12-month period (-27.7%). According to SKRADD, the wide dispersion of returns among the comparative set is noteworthy, with 12-month returns ranging from -0.5% to -27.7%. SKRADD said a number of factors could explain this phenomenon, including sector focus, use of leverage and hedging, and differing property underwriting and valuation practices.

SKRADD also provides a comparison of its indices against several benchmark indices. The SKRADD indices generally correlated with but outperformed two benchmarks produced by the National Council of Real Estate Investment Fiduciaries, or NCREIF, that also measure performance of private real estate: the NCREIF Fund Index – Open-end Diversified Core Equity (ODCE); and the NCREIF Property Index (NPI).

In contrast, the S&P United States REIT Index (SP US REIT), which measures the performance of traded REITs and has historically often been a leading indicator of private-real-estate performance, showed greater volatility than the SKRADD indices over the trailing three-year period. The SP US REIT index experienced a sharp decline between December 2021 and September 2022, during which time the SKRADD indices were showing positive performance. The performance of the SKRADD indices began turning negative during the fourth quarter of 2022 and declined through 2023. This was while the SP US REIT experienced positive performance buoyed by a particularly strong 2023 Q4.

Alternative Investment Data and Research, or Altidar, is a comprehensive research platform built to support advisers’ understanding and execution of alternative investment opportunities. Altidar.com offers access to more than 80 alternative investment funds, including interval and other closed-end funds, non-traded business development companies, and non-traded real estate investment trusts.

For more Snyder Kearney LLC news, please visit their directory page.