Retail Alts Investments’ Capital Formation Up 74% Year-Over-Year in January

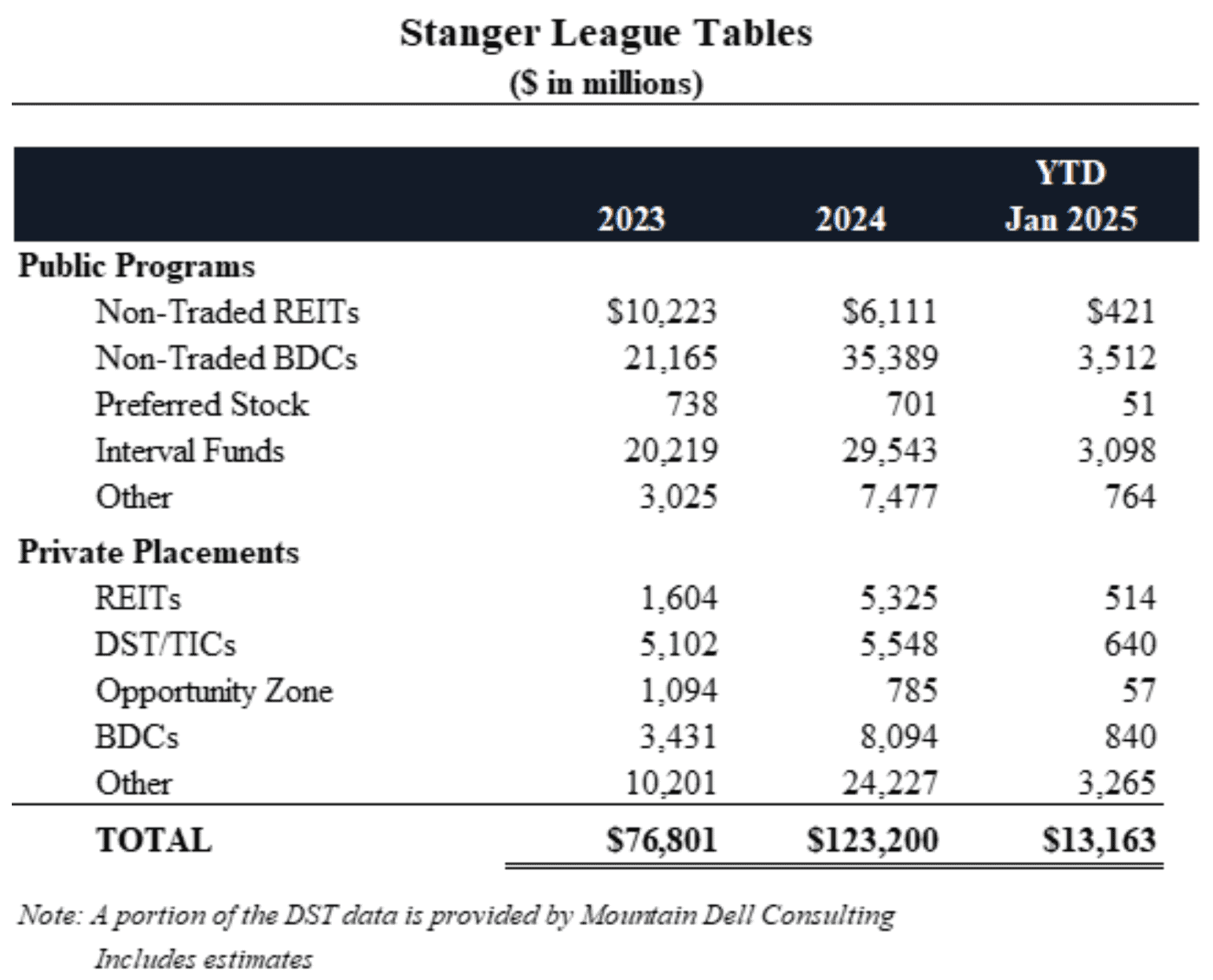

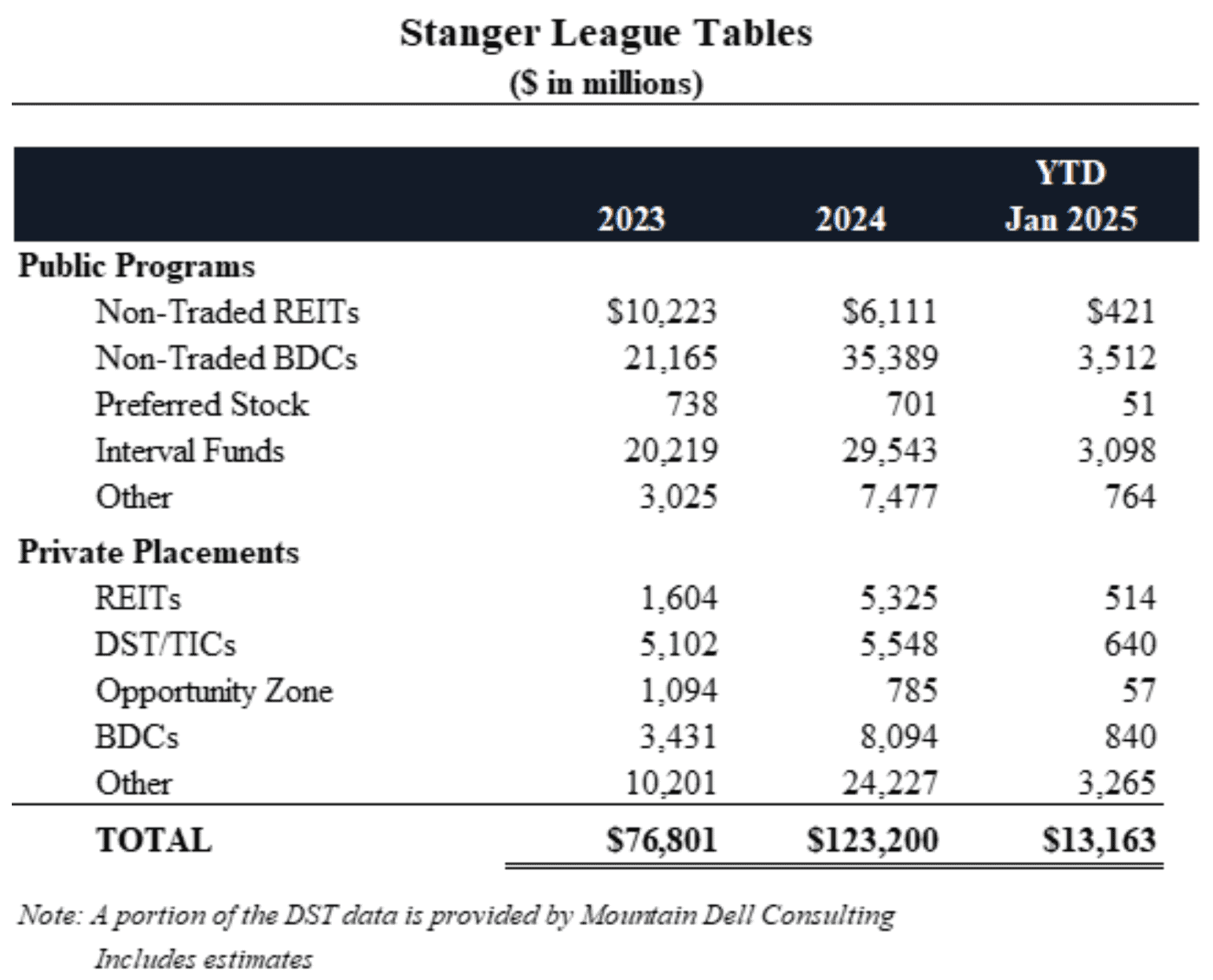

Alternative Investment fundraising among illiquid and semi-liquid offerings distributed to retail investors totaled approximately $13.2 billion in January, according to the latest data provided by investment banking firm Robert A. Stanger & Company Inc. This was led by non-traded business development companies at an estimated $3.5 billion, interval funds at $3.1 billion and other private placements, including infrastructure and private equity offerings, at $3.3 billion.

The Stanger data includes fundraising figures of alts investments offered via the retail pipeline, such as public non-traded real estate investment trusts, non-traded BDCs, interval funds, non-traded preferred stocks, Delaware statutory trusts, opportunity zone funds, private BDCs, private REITs and other private placements.

Both non-traded BDC fundraising and non-traded net asset value REIT fundraising are up nearly 32% while alternative investment fundraising collectively was up an impressive 74% in January 2025 compared to January 2024.

“Alternative Investment fundraising came out of the gates hot in the new year with credit, infrastructure, and private equity offerings leading the charge. After 2024 saw nearly $123 billion raised, we believe alternative investment capital formation could exceed $160 billion in 2025,” said Kevin T. Gannon, chairman of Robert A. Stanger & Co., Inc.

Stanger highlighted that the rapid increase in alternative investment fundraising in the retail investor space is in part due to the vast expansion of new offerings by both new entrants and veteran issuers. In addition to a newly effective public NAV REIT offering by StratCap Investment Management and a public non-listed BDC offering from Antares Capital, a second non-listed BDC offering by HPS Investment Partners remains in registration.

“Blackstone’s newly effective ‘BXINFRA’ reported initial sales of over $1 billion raised from individual investors in a private offering,” said Randy Sweetman, executive managing director at Robert A. Stanger & Co., Inc., noting that private placement offerings for public reporting companies remain popular and give retail investors access to infrastructure and private equity type investments.

The top fundraisers in the alternative investment space year-to-date are Blackstone, Cliffwater, Kohlberg Kravis Roberts & Co, Ares Management Corporation, and Blue Owl Capital.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.