RealSource Properties REIT Attributes End-of-Year NAV Decline to Ohio Property

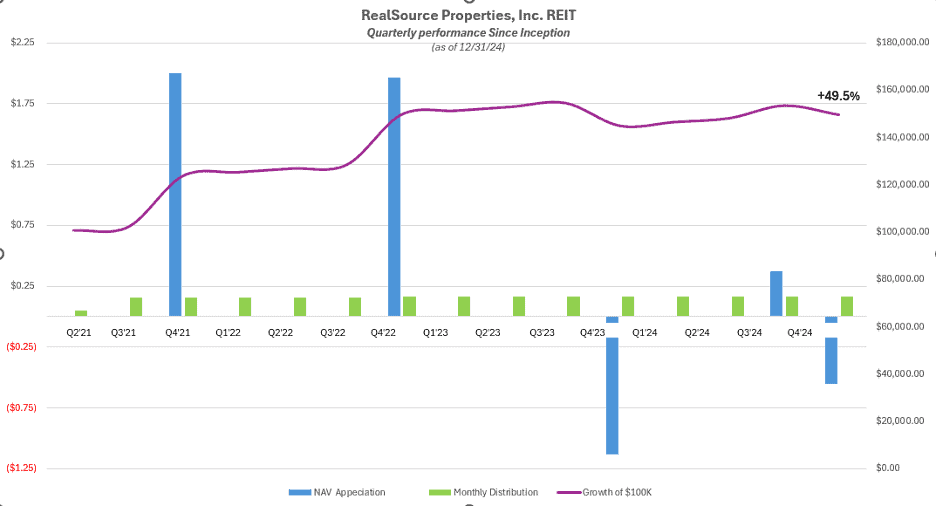

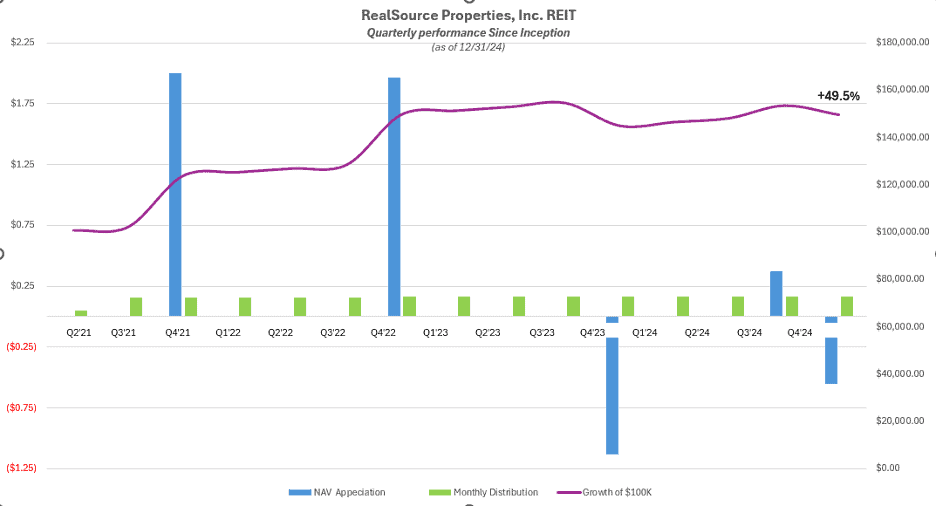

RealSource Properties Inc. REIT, a multifamily real estate investment trust launched in May 2021, has recently declared its latest net asset value in conjunction with third-party valuation firm Altus Group. Effective Dec. 31, 2024, and based on operating results as of Oct. 31, the REIT comprises 12 properties diversified across six states and totals approximately $567 million in real estate assets.

The board of directors approved a net asset value of $12.6501, down $0.18 or 1.4% year-over-year, ending Dec. 31. The REIT was down $0.55 or 4.2% from its $13.2003 third quarter 2024 valuation.

The company contributed the bulk of its NAV decline is attributed to an Ohio property anticipating a “significant increase in tax valuation for property tax purposes that may put downward pressure on the property market value.”

According to the fund, it opted to share this information to be transparent and exercise conservative pricing. It said that “although interest rates and cap rates were minor headwinds, the balance of the portfolio saw modest gains.”

“Our commitment to transparency and conservative valuation practices ensures investors have a clear view of portfolio performance,” said Kelly Randall, President of RealSource Properties. “While this particular property posed temporary challenges, our portfolio remains fundamentally strong, and we are actively managing assets to maximize returns for our investors.”

The REIT has paid monthly distributions, currently $0.65 per share, annualized, uninterrupted since inception. This has provided a cumulative income stream of approximately 23% on top of its NAV appreciation of 26.5% for a total return of 49.5% since launch.

RealSource Properties Inc. is a commercial real estate investment manager launched in 2002.

Click here to visit AltsWire directory page.