Non-traded NAV REITs Reportedly Outperforming Traded Counterparts

Starwood Real Estate Income Trust Inc, a publicly registered non-traded real estate investment trust sponsored by Starwood Capital Group, has registered a $5 billion follow-on offering.

Non-traded net asset value REITs are outperforming their traded alternative, per a new report from investment banking firm Robert A. Stanger & Co.

Robert A. Stanger & Co., Inc., the investment banking firm that specializes in the non-traded alternative investment industry, released the Fall 2020 edition of its IPA/Stanger Monitor, which reports that both publicly traded and non-traded REIT performance continued to improve in the third quarter from the heavy toll that COVID-19 took on real estate securities during the first quarter of 2020.

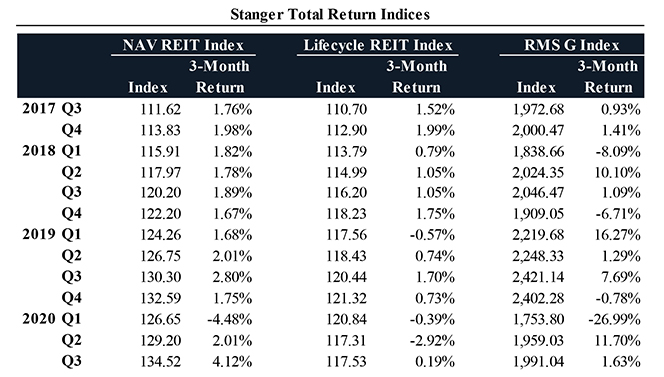

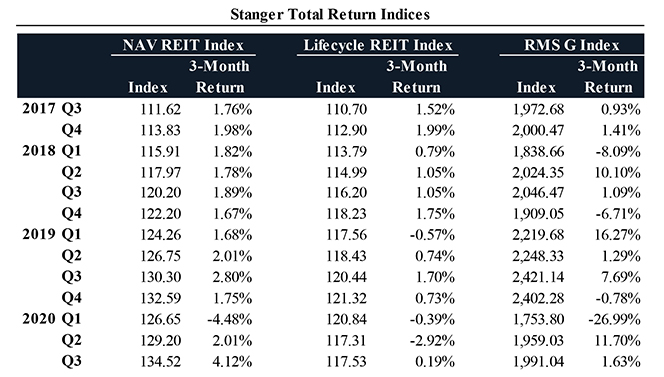

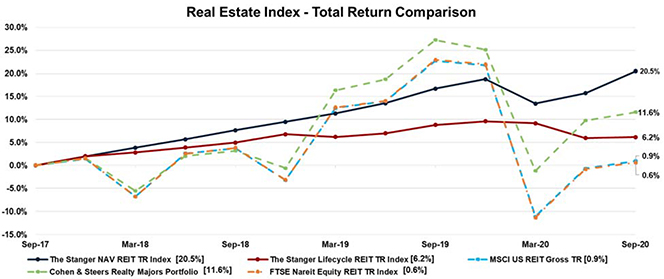

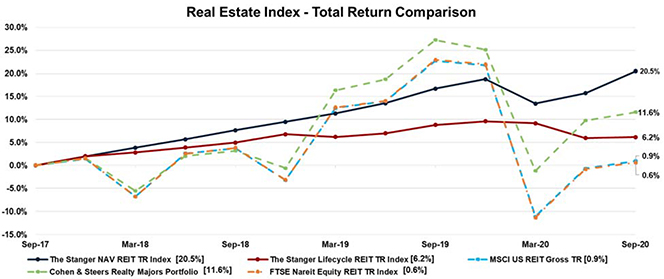

In the first quarter, extreme volatility had a negative impact on returns in the traded market, as evidenced by a 27% loss in the MSCI US REIT Index Gross Total Return (RMS G), followed by an 11.7% gain during the second quarter and much smaller 1.6% gain during the third quarter of the year.

Year-to-date through September, the RMS G is in the red with a -1.1% total return, while the 36-month total return of this broader REIT market index was only 0.9%.

According to Stanger, non-traded net asset value REITs suffered less dramatic declines in the first quarter, posting a 4.5% loss as measured by the Stanger NAV REIT Total Return Index, followed by a 2.0% gain during the second quarter and a 4.3% gain in third quarter 2020.

Year-to-date 2020, the Stanger NAV REIT Index gained 1.5%. NAV REITs posted a far superior return than their traded counterparts over the 36-month period ended September, recording a cumulative total return of 20.5%.

“This performance only serves to highlight the benefits of a non-listed REIT vehicle, providing a real estate-based return without the extreme ongoing volatility of the traded market,” said Kevin T. Gannon, chairman and chief executive officer of Stanger.

The IPA/Stanger Monitor, authored and published by Stanger, is sponsored by the Institute for Portfolio Alternatives.

“The latest numbers are a testament to the resiliency within the alternative investments industry,” Tony Chereso, president and chief executive officer of the Institute for Portfolio Alternatives, said. “Although no asset class went unscathed as a result of the ongoing pandemic, it’s clear that real estate fundamentals remain strong and that NAV REITs and similar alternative asset classes are positioned well to deliver long-term returns to investors regardless of the overall economic environment.”