Non-Traded BDCs Near $100 Billion NAV as Fundraising Hits Record $35 Billion in 2024

Non-traded business development companies saw a 55.6% year-over-year rise in aggregate net asset value and a 10% increase quarter-over-quarter, closing the year at $95.9 billion, according to investment banking firm Robert A. Stanger & Company Inc.

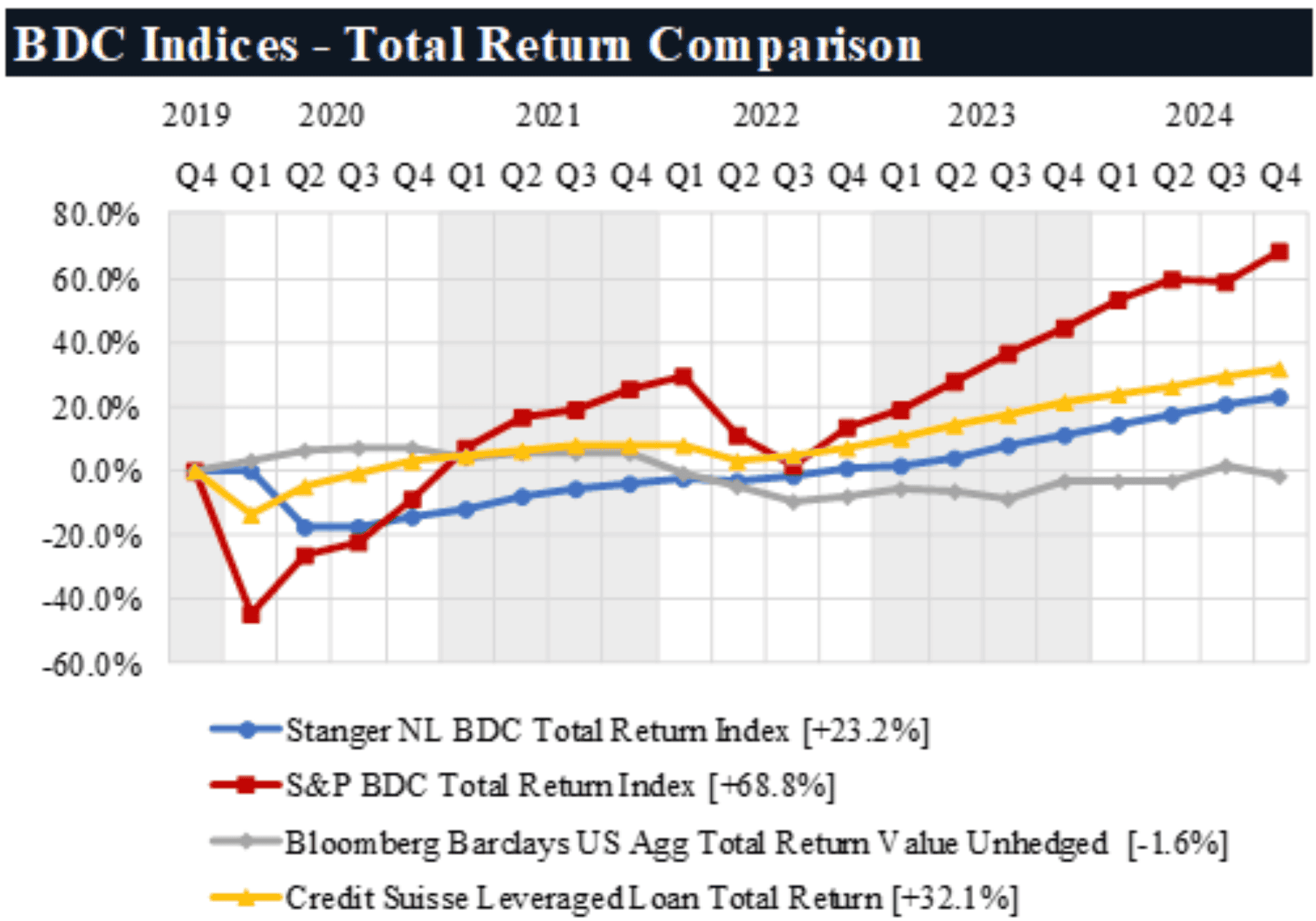

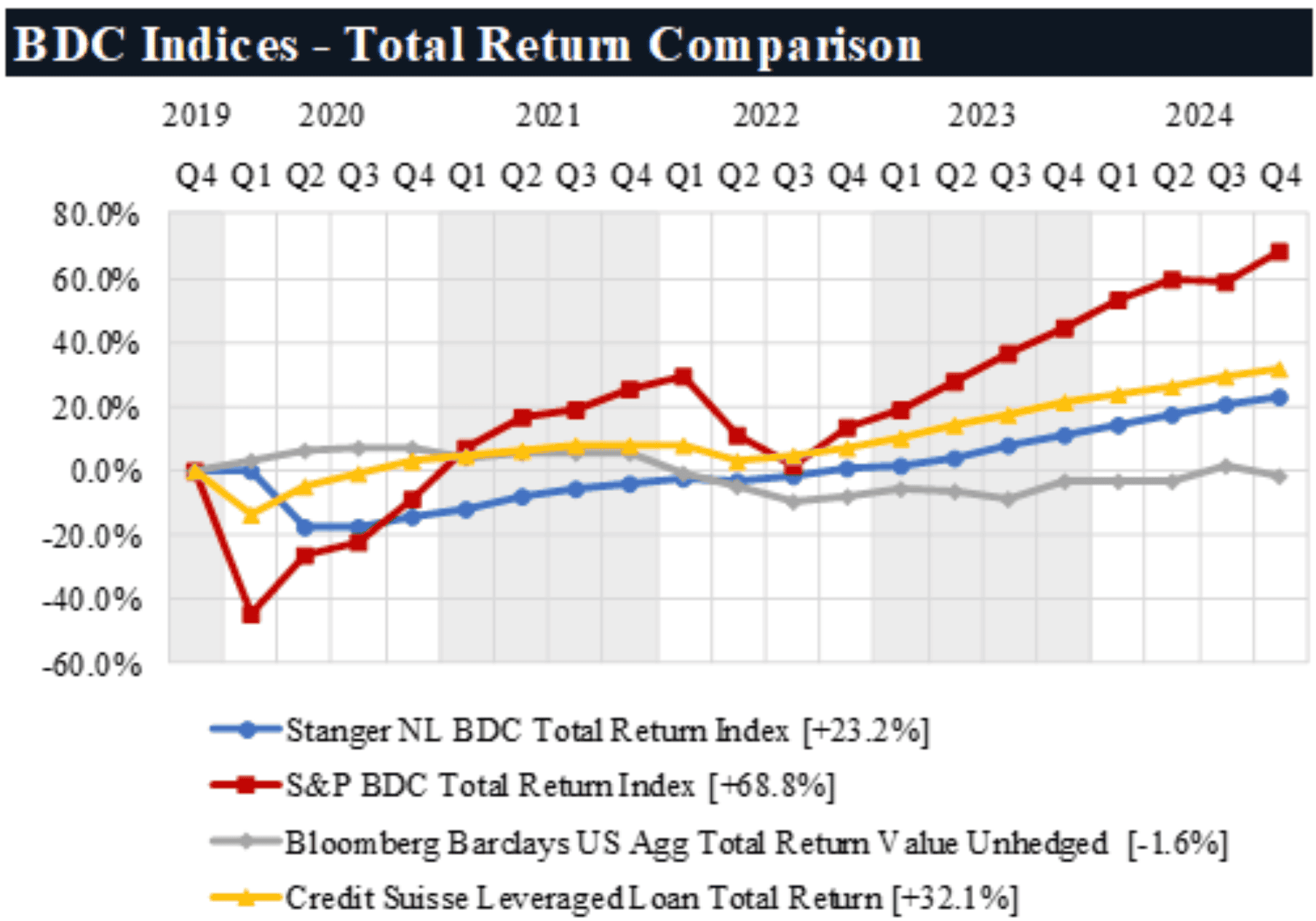

Following a 2.4% increase in Q3 2024, the Stanger Non-Listed BDC Total Return Index posted a 2.3% gain in Q4 2024, its 10th consecutive quarter of steady growth – bringing its full year return to 10.7%. These returns continue to trail their publicly traded BDC counterparts, which delivered a 16.6% total return for the year.

“The non-traded BDC market, alongside other credit-focused investment products, continues to attract substantial retail capital,” said Kevin T. Gannon, chairman and chief executive officer of Stanger. “Fundraising in 2024 surged 67% year-over-year, surpassing $35 billion.”

“With $10 billion in new offerings going effective this year and another $6 billion registered in Q4 alone, the momentum remains strong. As we enter 2025, we expect continued growth, fueled by increasing demand for private credit strategies and attractive yields,” added Gannon.

PGIM Private Credit Fund led the non-traded BDC market in Q4 2024, topping both the three-month (3.6%) and one-year (14.0%) total return rankings. For longer-term performance, Blue Owl Credit Income Corp. remained the top-performing non-listed BDC over three years, while Blue Owl Capital Corp. II edged out Q3 leader, MSC Income Fund, Inc. to claim the best five-year total return.

“MSC Income Fund, a traditional non-traded BDC, began trading on the NYSE on Jan. 29, 2025,” stated Gregory R. DiSalvo, managing director at Stanger. “On Feb. 6, its shares closed at $16.88, reflecting an 8.7% gain from the initial offering price of $15.53 and a 9.1% premium to its most recently reported NAV per share.”

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.