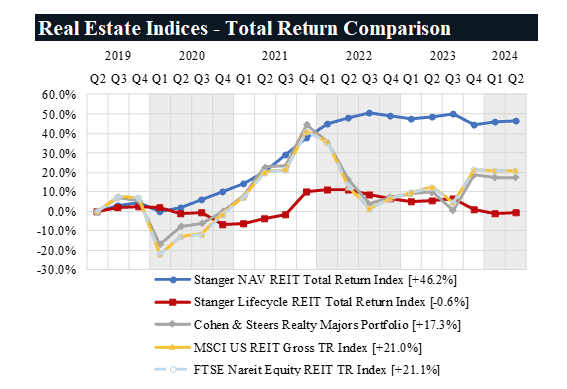

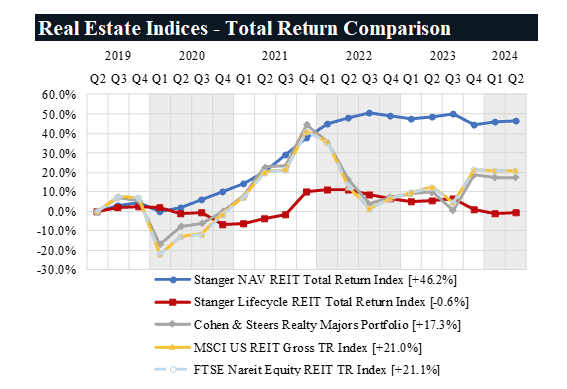

NAV REITs Continue to Outperform Traded REITs in Q2 2024

The Stanger NAV REIT Total Return Index saw a modest gain of 0.3% in the second quarter of 2024, its second consecutive quarter of positive returns and fourth in the past five quarters. Net asset value real estate investment trusts continue to show strong overall performance over the past five years with an annualized return of 7.9%, more than double that of traded REITs.

The Stanger Lifecycle REIT Index rebounded after a negative return to start the year, gaining 0.4% in Q2 2024.

“Despite the comparatively robust performance of publicly traded REITs over the past 12 months, the Stanger NAV REIT Index continues to outperform publicly traded indices over a five-year period. Its impressive 7.9% annualized return is more than double that of the top-performing traded REIT index for the same timeframe,” said Kevin T. Gannon, chief executive officer and chairman of Robert A. Stanger & Co., Inc.

The second quarter of 2024 was marked by significant actions from several sponsors, recounted Stanger. KKR introduced a shareholder priority plan to establish a future NAV per share floor, Ares closed both public offerings – Ares Real Estate Income Trust and Ares Industrial Real Estate Income Trust – and launched perpetual private offerings of the same REITs, and Starwood reduced the monthly and quarterly capacity of its share repurchase program.

“Buckle up … it will be interesting to see how the market responds to these developments throughout the remainder of the year,” added Gannon.

J.P. Morgan Real Estate Income Trust secured the top position in the three-month return rankings with a 3.2% quarterly return. FS Credit Real Estate Income Trust, a mortgage-focused REIT, retained its leading status in the one-year total return rankings for the second consecutive quarter. In the longer term, Ares Industrial REIT surpassed Cottonwood Communities to claim the top spot in the three-year rankings, while Blackstone Real Estate Income Trust continues to dominate the five-year return category.

Among lifecycle REITs, Highlands REIT emerged as the top performer over 12 months, and SmartStop Self Storage REIT ascended to the top of the three-year return rankings. Lightstone Value Plus REIT V, specializing in multifamily properties, maintained its leadership in five-year total returns.

There were no new public non-traded REIT registrations or entrants during Q2 2024. Sila Realty Trust, a lifecycle REIT, commenced trading on the NYSE in June 2024.

These results, as well as individual performance data, profiles on currently effective and newly registered stock offerings, and fee structure comparisons on 20 NAV REITs are published in the newly released Q2 2024 Non-Listed REIT edition of The Stanger Report.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.