KKR Announces Shareholder Priority Plan to Enhance NAV REIT Returns

KKR Real Estate Select Trust Inc. – a ’40 Act closed-end fund that qualifies for tax treatment as a real estate investment trust with $1.2 billion in aggregate NAV – has announced a shareholder priority plan to enhance returns for its investors.

Affiliates of KKR have pledged that if NAV per share is below $27.00 on June 1, 2027, they will cancel up to 7.7 million shares of KREST they own to support a NAV per share of $27.00. If cancellation is insufficient to bring NAV per share up to $27.00, all such 7.7 million shares will be cancelled. The value of any cancelled shares will accrue to the benefit of existing shareholders at such time, giving them a preferred priority return over KKR affiliates. In addition, affiliates of KKR will inject $50 million of new capital into KREST to be on equal footing with shareholders (the associated shares issued would not be part of the 7.7 million shares subject to cancellation). KREST indicated that it intends to maintain its annualized gross distribution per share of $1.56 over the course of the preferred return period.

“This move insulates KREST shareholders from a 16% decline in NAV while providing KREST with $50 million of added liquidity on top of its robust liquidity sleeve and financing capacity estimated at 28% of NAV already,” stated Kevin T. Gannon, chairman and chief executive officer of Robert A. Stanger & Co., Inc. “This is a smart and bold move to offer enhanced downside protection for returns that has the potential to reignite fundraising at KREST.”

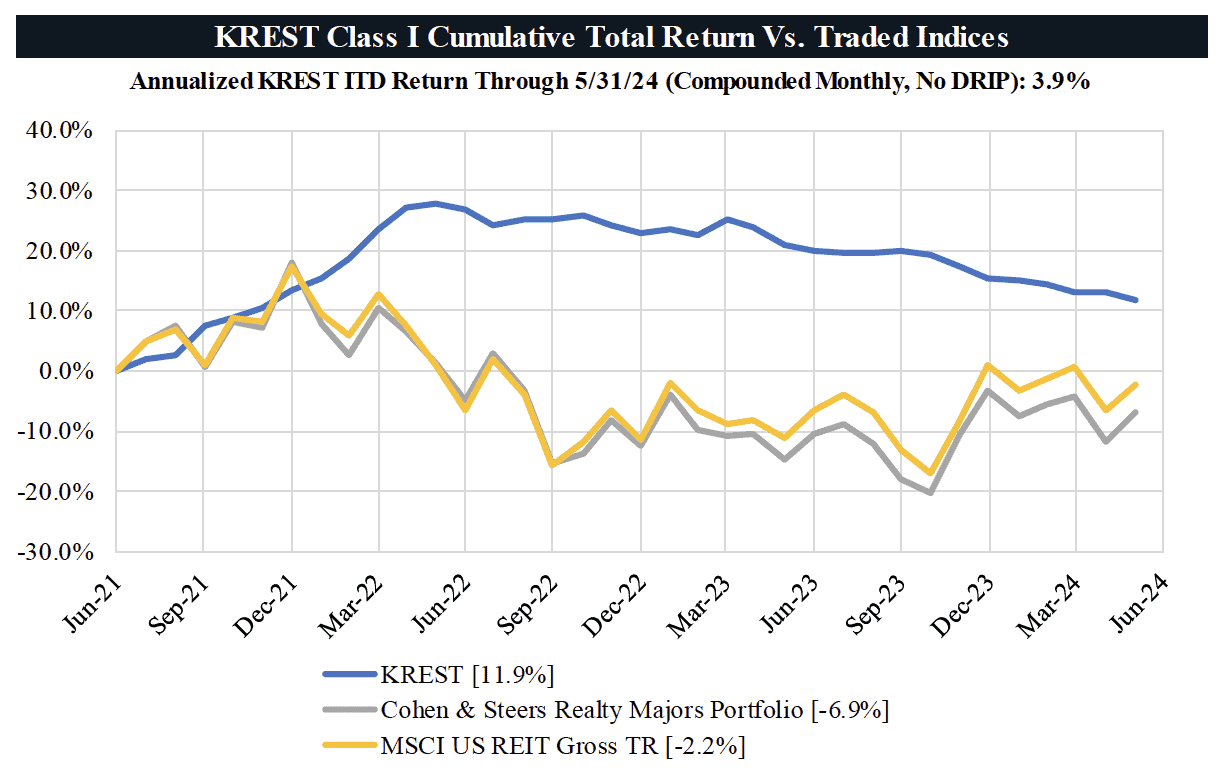

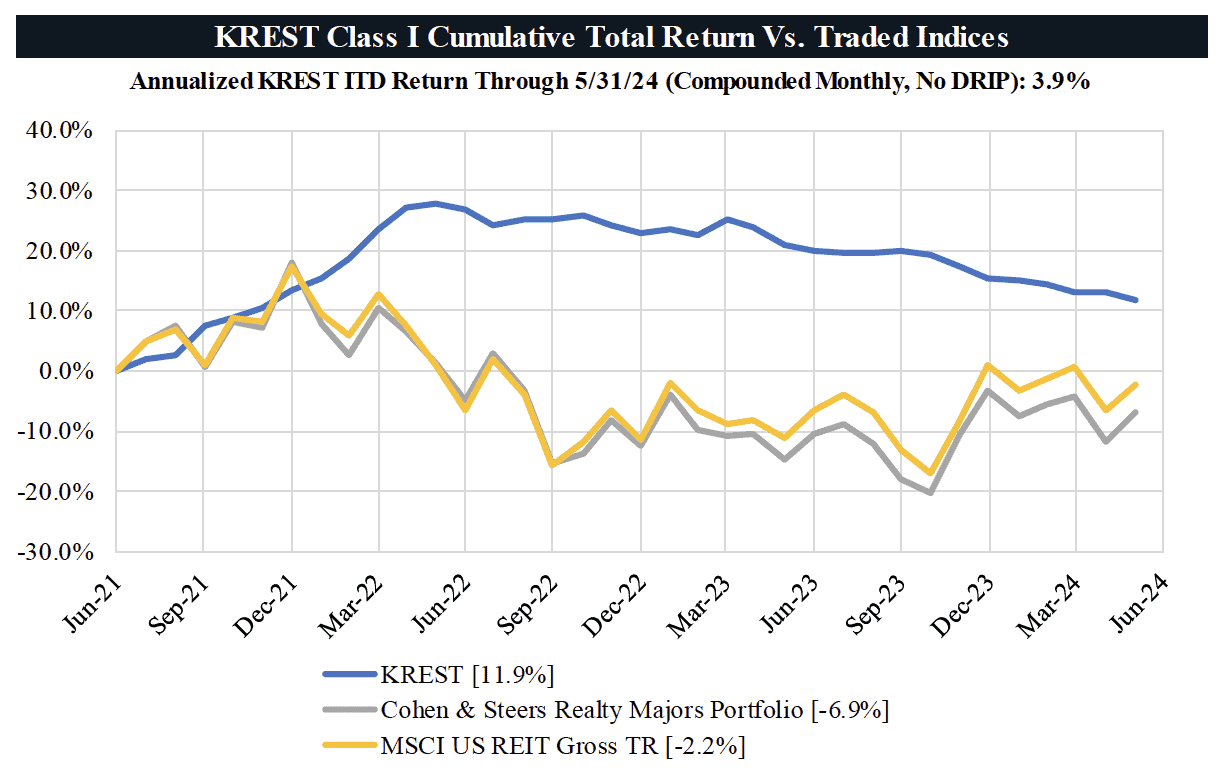

As previously reported by AltsWire, global investment firm KKR launched the registered closed-end fund in May 2021 with a primary investment objective to provide attractive current income and a secondary objective of long-term capital appreciation. The then-$2 billion offering, comprised of four classes of common stock – Class I, Class U, Class D, and Class S shares — is open to all investors.

It reported negative total returns in excess of 6% in 2023.

At a NAV of $25.56 per share, the 7.7 million shares equate to nearly $200 million of equity in KREST is that is being subordinated. Three three-year annualized priority return to Class I common stockholders implied by the $27.00 and the current annual gross distribution of $1.56 per share is 8%. Assuming the share count is held constant as of April 30, 2024:

“The announcement comes after KREST’s Q2 2024 self-tender offer was oversubscribed by a factor of two-to-one, but also at a time following a historically large correction to real estate valuations that have created more attractively priced investment opportunities,” stated David J. Inauen, head of research at Stanger. “KKR is sending a clear message that it would rather be putting capital to work in real estate instead of cashing out investments, and it is putting its money where its mouth is, to the benefit of KREST’s shareholders.”

KREST maintains a liquidity sleeve consisting of cash, short-term assets, liquid securities, and availability under its $250 million credit facility. KREST reports that its liquidity sleeve totaled approximately 28% of NAV as of April 30, 2024, which provides support to fund over five quarters of self-tender offers at maximum intended capacity of 5% of NAV per quarter.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.