Industrial Real Estate in 2025: The Trends and Takeaways

By Damon Elder

Insights From the Publisher: With key demand drivers and rebalanced supply and demand, industrial real estate may offer opportunities and challenges in the year ahead.

By Damon Elder, publisher and editor-in-chief, AltsWire

Similar to multifamily real estate, industrial real estate – including manufacturing, warehousing, distribution and other similar properties – has long been considered a cornerstone of commercial real estate. With a new presidential administration underway, 2025 could be a dynamic year for the asset class, shaped by forces like nearshoring and reshoring initiatives and e-commerce, along with potentially promising market dynamics.

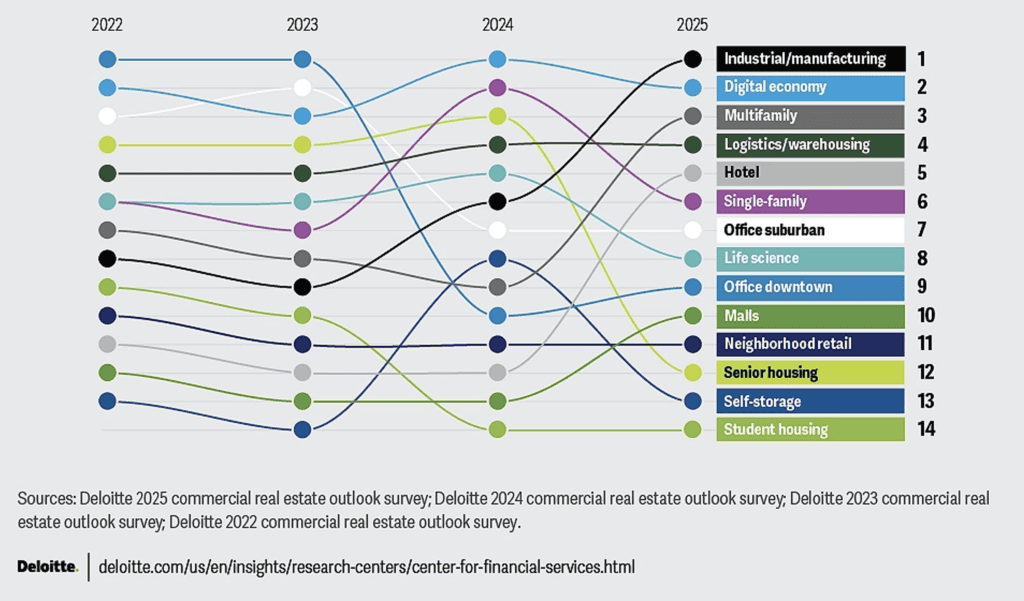

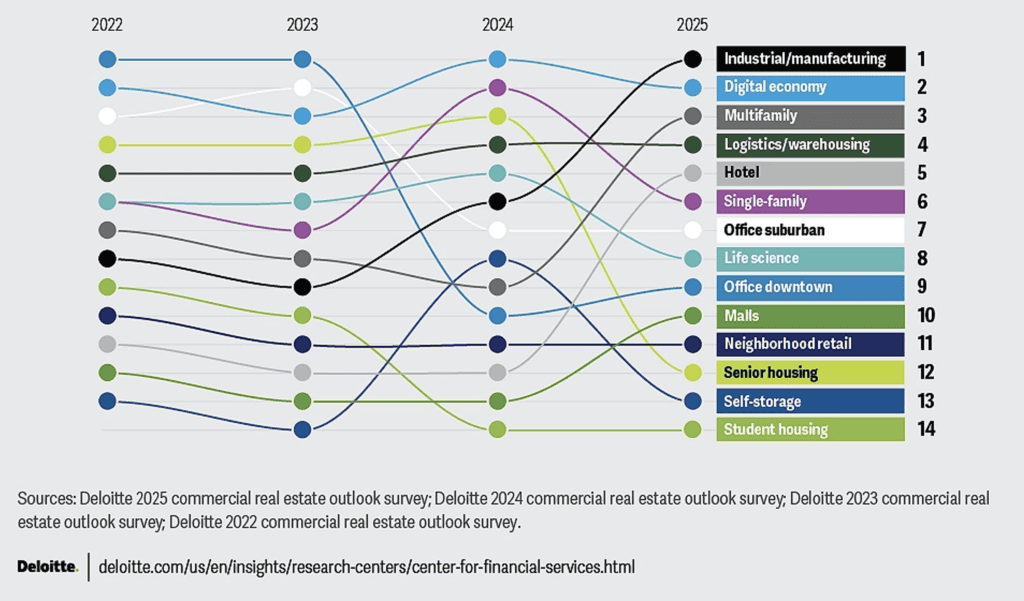

According to a Deloitte survey of C-level real estate executives, industrial real estate may present the greatest opportunity for real estate investors over the next 12 to 18 months.

Key Trends to Watch

Between the pandemic, U.S.-China trade tensions and high inflation, a significant reorganization of supply chains has occurred, contributing to a surge in nearshoring and reshoring of manufacturing to the United States. With the new administration and proposed trade policy, such as an increase in tariffs, this trend may be expected to continue. President Trump previously proposed tariffs of 60% to 100% on Chinese goods and has since lowered that percentage proposal to 10% in the last week.

Regardless, tariffs could contribute to a need for more storage inventory and more warehousing and third-party logistics, or 3PL, services. 3PLs generally provide more inventory flexibility while allowing businesses to focus on their core business competencies.

Locations along the U.S.-Mexico border, or near major north-south highways like Interstates 29 and 35, may also be set to benefit. Mexico offers access to a highly skilled, lower-cost labor force that can manufacture products that require large warehouse and distribution operations, but Mexico is also currently experiencing a record-low industrial vacancy rate, according to CBRE. This could mean that companies may need to open more U.S. distribution centers to store and distribute the product. While President Trump has proposed a punitive 25% duty on Mexican imports, having a Mexico-adjacent warehouse could be as important as having a seaport location for some companies – especially with proposed tariffs on Chinese products.

Similarly, President Trump boasted during his campaign that he could end the war in Ukraine in 24 hours, but certain advisers said a ceasefire is months away, according to Reuters. The war in Ukraine, conflict in the Middle East, and other geopolitical uncertainties are also likely to contribute to the reshoring trend.

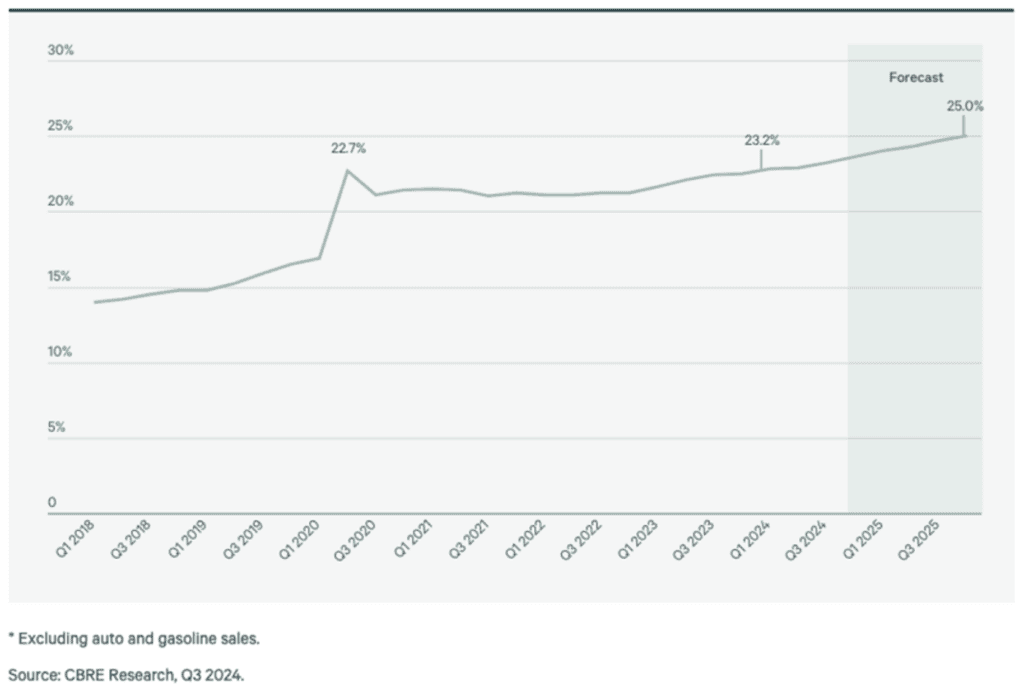

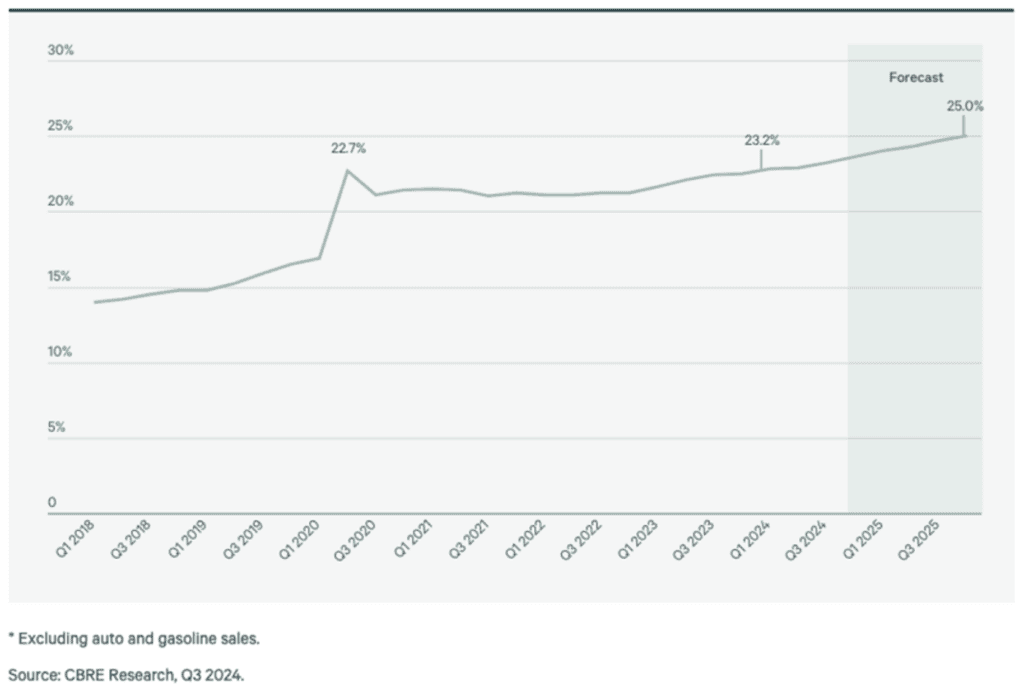

Another key trend continues to be the rise of e-commerce. According to CBRE, the e-commerce share of total retail sales hit a record high of 23.2% in the third quarter of 2024. This is only expected to increase to 25% by the end of 2025, also contributing to the demand for greater warehouse and distribution space.

Along with e-commerce, warehouse automation technology is growing quickly, and data analytics, AI, and collaborative robots are expected to be increasingly used – working alongside humans, rather than replacing jobs. This may lead to a “flight to quality” and a demand for newer industrial buildings in primary markets that can handle the robust power needs, floor space, and other requirements that these robots demand.

E-Commerce Share of Total Retail Sales

Supply and Demand May Balance Out

Vacancy rates are anticipated to peak in mid-2025, as supply and demand is expected to come back into equilibrium. This may be attributed largely to a sharp drop in construction. Colliers has reported that, after peaking at 711 million square feet during the fourth quarter of 2022, total space under construction is expected to drop below 300 million square feet by early 2025, a decrease of more than 57%.

Like supply, demand has also slowed. From late 2020 to 2022, net absorption exceeded 100 million square feet per quarter. In 2024, however, net absorption averaged only 38 million square feet per quarter. In 2025, Colliers expects net absorption to increase from its 2024 levels, while it is unlikely to return to its levels of the early 2020s. Demand for new, modern buildings should remain strong in primary markets.

Despite rising vacancy and a slowdown in demand, rent has continued to increase. At the close of the third quarter of 2024, the average rate reached $10.08 per square foot, surpassing $10 for the first time in history, according to CRE Daily. Colliers predicts that rent growth will continue, though at more typical rates of 3% to 6% year-over-year, as opposed to the 9% in the third quarter of 2024.

Understanding the Obstacles

As with any asset class, industrial real estate is also likely to face its share of challenges this year. Tariffs may contribute to more nearshoring and reshoring but may also lead to rising inflation and higher material costs.

Older industrial buildings that cannot handle the modern needs of AI and automation may have to wait for newer properties to be occupied before these properties see an increase in demand. CBRE stated that buildings constructed before 2000 accounted for more than 100 million square feet of negative absorption in 2024, while properties built after 2022 posted more than 200 million square feet of positive absorption. This trend is likely to continue as long as more modern, first-generation buildings are available. Older buildings may do well to invest capital to modernize the space if possible.

Key Takeaways for the Alternatives Space

Driven by factors like onshoring, e-commerce and automation technology, it appears that the industrial real estate market is poised to remain strong in 2025. Rent growth is also expected to remain strong as supply and demand finds more of an equilibrium. Modern buildings that can facilitate the needs of today’s technology, especially those in primary markets with high barriers to entry, may continue to be attractive to investors and sponsors. Older buildings may possibly be able to jump on this trend as well if they have the ability to make capital improvements in a feasible manner. Otherwise, these buildings may find themselves waiting on the sidelines. Regardless, anyone who is potentially interested in an industrial asset must do their due diligence to ensure that the investment aligns with their long-term goals.

Damon Elder is the publisher and editor-in-chief of AltsWire, as well as president of Spotlight Marketing Communications. He has worked in the alternative investments industry for nearly 20 years and was previously a congressional aide and political consultant before finding honest work in the private sector. Agree or disagree with what you read here? Share your views with him at [email protected]. Thoughtful replies may be published in AltsWire.

The information provided in this article is for educational purposes only and should not be considered investment advice. Investing in real estate involves risks, and past performance is not indicative of future results. Consult with a qualified financial adviser before making any investment decisions.