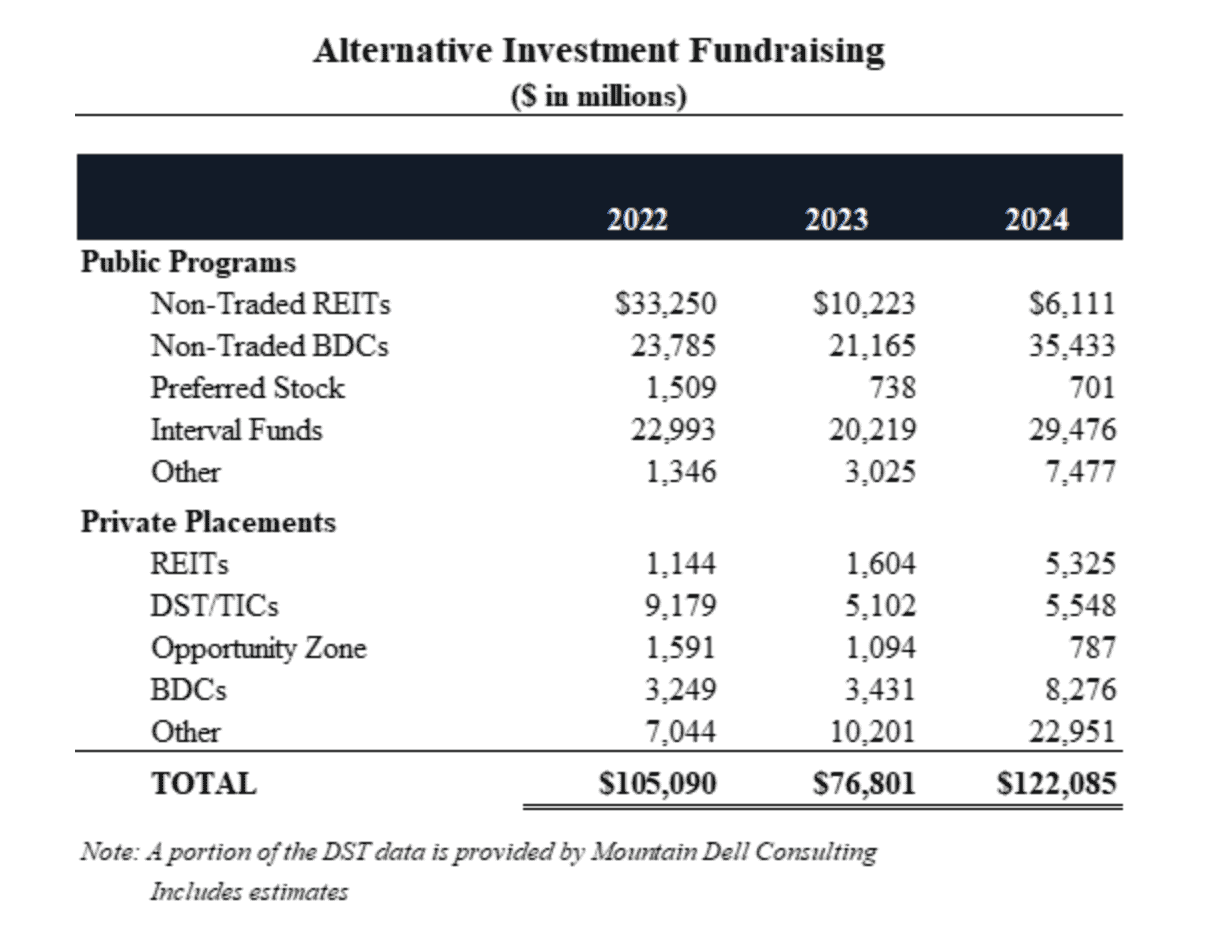

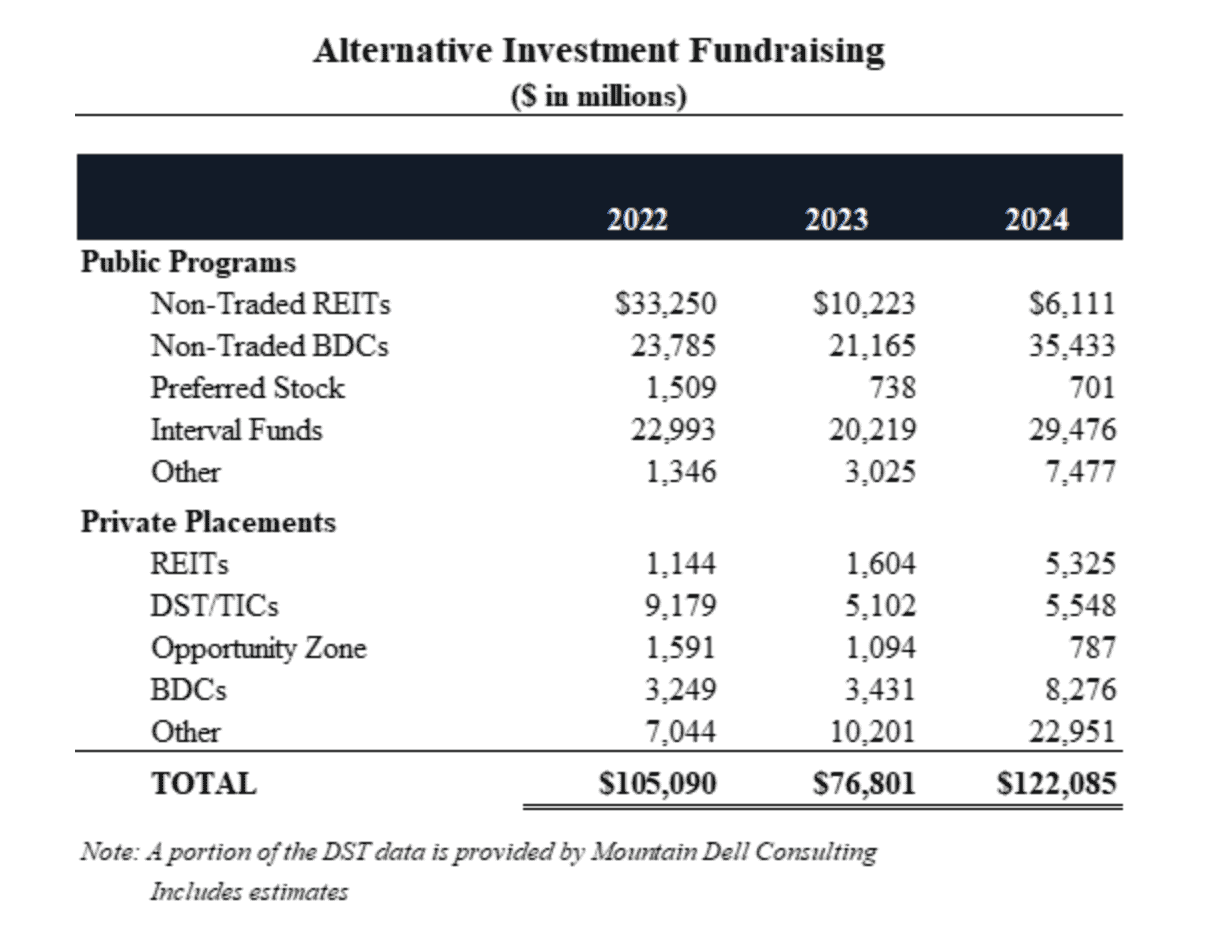

Alts Fundraising Surpasses $122B for 2024, Led by Non-Traded BDCs With $35.5B

Alternative Investment fundraising exceeded $122 billion for 2024, surpassing the 2022 high water mark of $105 billion by nearly $17 billion, led by publicly offered non-traded BDCs at an estimated $35.5 billion and interval funds at $29.5 billion, according to data provided by investment banking firm Robert A. Stanger & Company Inc.

Stanger’s coverage universe is comprised of public non-traded real estate investment trusts, non-traded business development companies, interval funds, non-traded preferred stocks, Delaware statutory trusts, opportunity zone funds, private BDCs, private REITs, and other private placements including infrastructure and private equity offerings.

Public non-traded and private REITs combined for over $11 billion while all private placements tracked by Stanger racked up over $42 billion of combined fundraising. The industry continues to transform as investors shift their portfolio allocations to credit-oriented products with higher yields while further allocating investments to infrastructure and private equity investments.

“Fundraising in business development companies, interval funds and private placements continue to dominate in the space as investors have shifted their investments away from non-traded REITs in 2024. Credit investments like non-traded BDCs and Interval funds have shown higher current returns in the high single digit to low double-digit distribution yields,” said Kevin T. Gannon, chairman of Robert A. Stanger & Co., Inc.

The top fundraisers in the alternative investment space year-to-date are Blackstone, Cliffwater, Blue Owl Capital, Ares Management Corporation, and Kohlberg Kravis Roberts & Co.

Blackstone led non-traded BDC fundraising in 2024 with nearly $11 billion raised, followed by Blue Owl Capital with $6.6 billion, Apollo Global Management ($5.6 billion), Ares Management Corporation ($4.1 billion), and HPS Investment Partners (estimated $3.4 billion) rounding out the list of top five fundraising sponsors. Stanger expects that fundraising in public non-traded BDC will continue its pace in 2025 and expects the full-year total to surpass $40 billion.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.